For businesses operating in high-risk industries like iGaming, Forex, and international e-commerce, especially across complex regions like LATAM, Africa, Southeast Asia, and Canada, successful payment processing isn’t a luxury; it’s a lifeline.

Every declined transaction represents lost revenue, frustrated customers, and increased churn. But what if you could intelligently route each transaction to the right payment provider, orchestrate the best path behind the scenes, and even rescue failed payments, all in real-time?

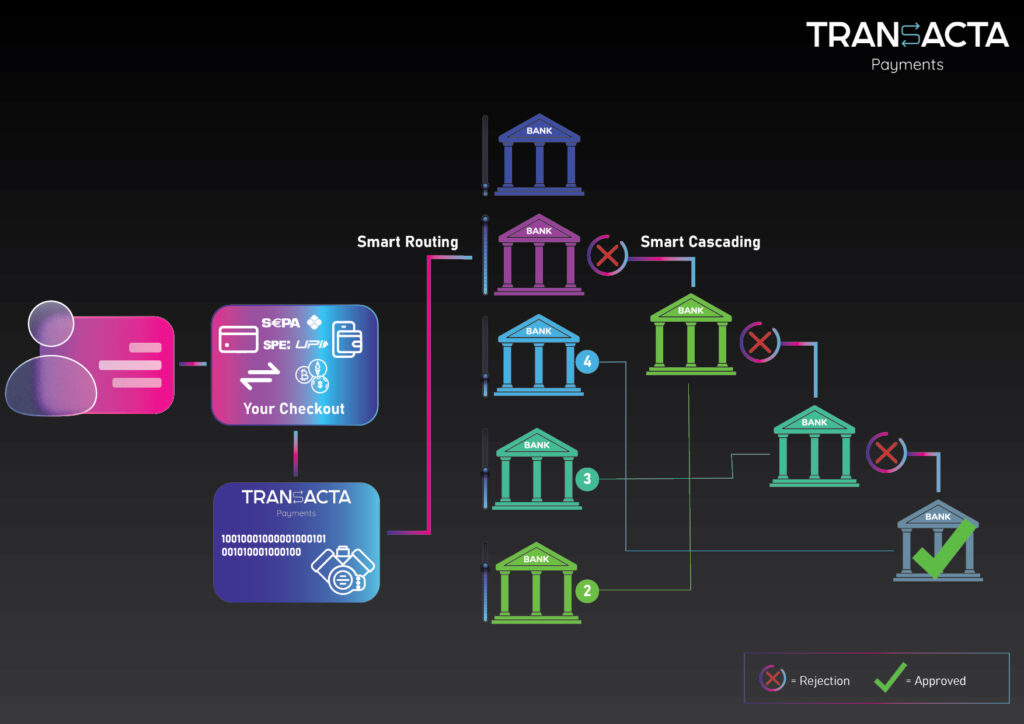

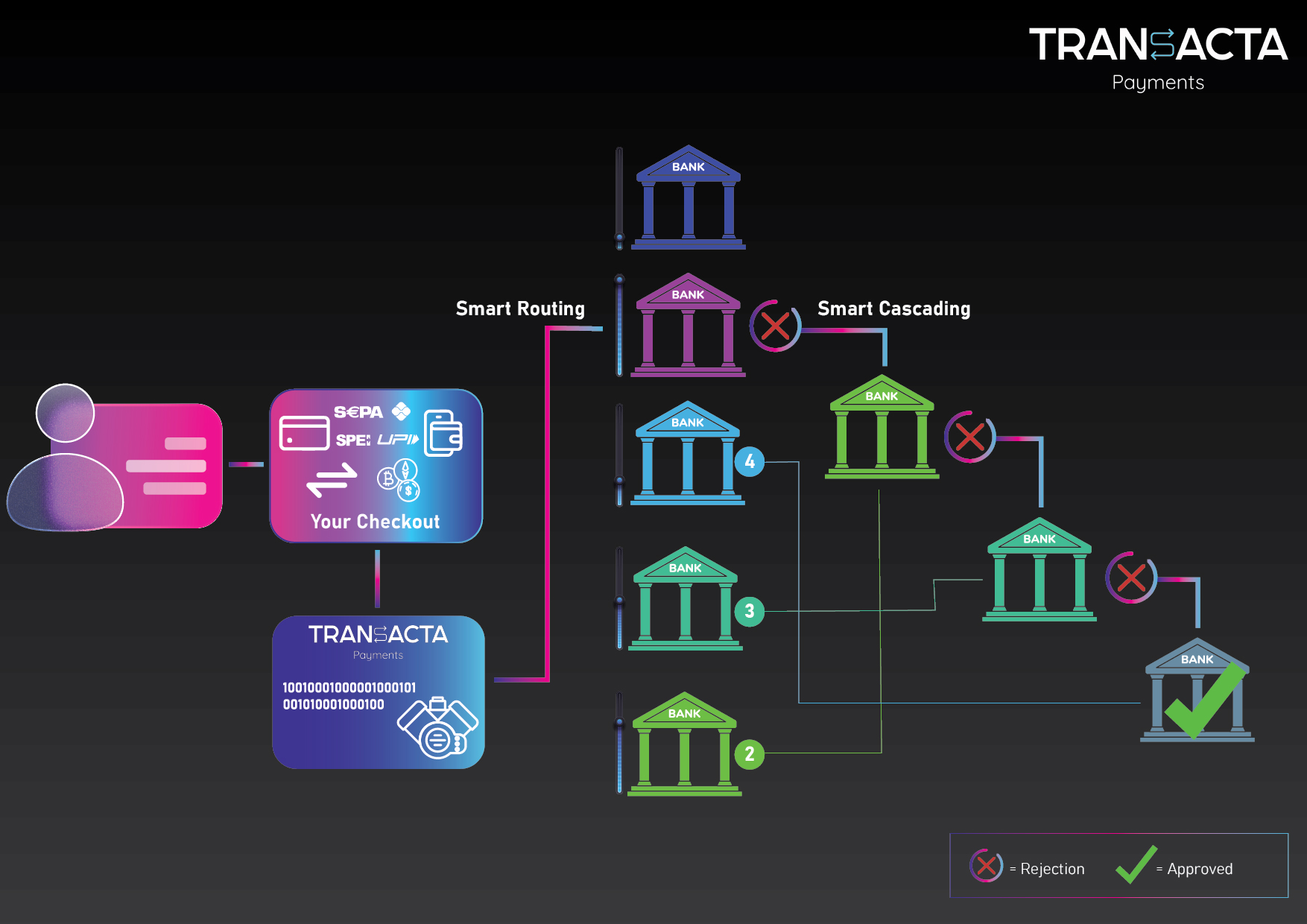

That’s exactly what Payment Orchestration, i.e., Smart Routing and Smart Cascading, is designed to do.

At TransactaPay, we specialize in payment gateway and orchestration solutions that optimize every transaction, from initiation to completion, using these powerful tools. In this article, we’ll explain what Smart Routing and Smart Cascading are, how Payment Orchestration underlies and powers them, and why these tools are essential, not optional, for high-risk, international businesses.

What Is Smart Routing?

Imagine you’re sending a package, you wouldn’t choose the slowest, most expensive courier. You’d choose the one that delivers quickly, reliably, and at the lowest cost.

Smart Routing does the same, but for digital payments.

➤ Definition:

Smart Routing is the real-time process of selecting the best available payment processor or acquiring bank for a transaction, based on data like:

- Card type (Visa, Mastercard, local networks)

- Customer’s location and currency

- Issuing bank behavior

- Acquirer performance history

- Processor costs and success rates

Instead of sending all payments to a single processor (which may not be ideal for every case), Smart Routing dynamically chooses the most appropriate route, maximizing the chance of approval and minimizing fees.

Here, Payment Orchestration acts as the underlying layer that ensures routing decisions are optimized across multiple providers, geographies, and cost-performance tradeoffs.

Real-World Example: Financial Trading in LATAM

A shopper in Argentina uses a locally issued card to buy from an e-commerce store. Without Smart Routing, the transaction might go to a U.S. or European acquirer and get declined due to a regional mismatch.

With Smart Routing, powered by orchestration, the payment is automatically routed to a local Argentinian acquirer with higher approval rates for domestic cards, resulting in a successful, smooth transaction.

What Is Smart Cascading?

Even with Smart Routing, some transactions fail due to technical issues, temporary bank outages, or fraud flags.

Smart Cascading is the system that says: “Let’s try again, intelligently.”

➤ Definition:

Smart Cascading is an automated fallback mechanism that attempts a failed transaction again, using different acquirers, routing paths, or parameters, based on the reason for failure.

The system analyzes why a transaction failed, then chooses the next best option to try again, all in real-time, without requiring the customer to resubmit anything.

Behind the scenes, this is powered by a Smart Payments Engine within the orchestration layer, which retries transactions multiple times across different PSPs without affecting the user experience. From the customer’s perspective, it feels instant and seamless, even though several re-attempts may have taken place in the background.

Real-World Example: iGaming Deposit in Southeast Asia

A user in the Philippines tries to deposit funds using a card. The first attempt fails due to a temporary acquirer error.

With Smart Cascading, the gateway—driven by orchestration—identifies the issue and reroutes the payment through an alternate acquirer with better availability, rescuing the transaction in seconds.

Payment Orchestration: The Underlying Framework

Payment Orchestration is the invisible layer that makes Smart Routing and Smart Cascading possible. It connects, manages, and optimizes multiple PSPs, acquirers, and payment methods through a single integration.

Rather than acting as a separate function, orchestration underpins the entire process, ensuring each transaction follows the smartest, most cost-effective, and highest-approval path available. It’s the conductor of the entire payment ecosystem—ensuring every instrument plays in harmony.

Why These Tools Are Essential, Not Optional

For high-risk businesses and global merchants, these technologies aren’t just efficiency upgrades—they are mission-critical.

Here’s why:

- Boost Approval Rates

High-risk industries often face higher decline rates due to stricter scrutiny from acquiring banks. Smart Routing, underpinned by orchestration, increases approvals by selecting the processors that understand and accept your industry profile. - Reduce Payment Failures

Technical errors, downtime, and outdated routing logic lead to failed payments. Smart Cascading, powered by orchestration, gives you a second (and sometimes third) chance to save the transaction, instantly. - Lower Processing Costs

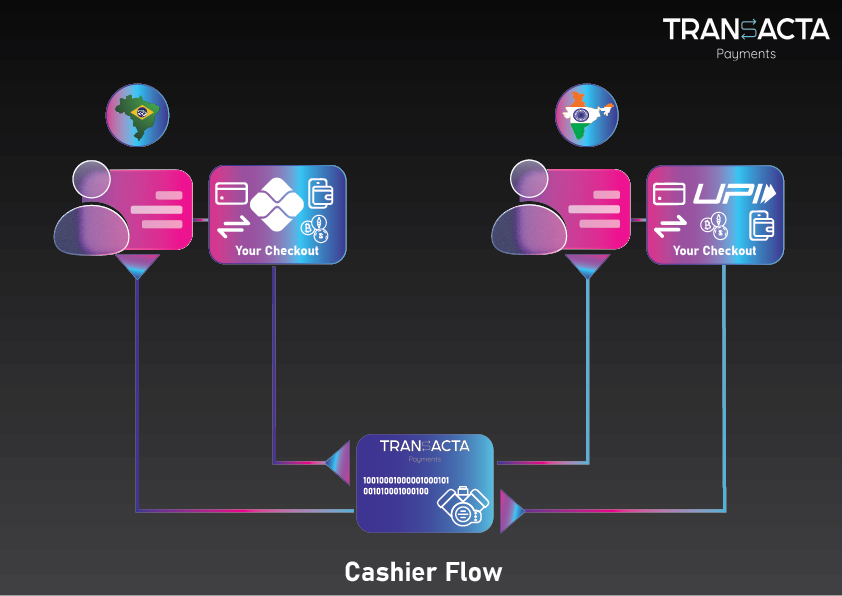

Routing all transactions to a single, high-fee processor can bleed your margins. Orchestration ensures Smart Routing selects the lowest-cost option that meets performance needs, saving you money at scale. - Adapt to Regional Preferences

In markets like LATAM, Africa, and Southeast Asia, local acquirers, card schemes, and alternative payment methods are often preferred. Our orchestration-driven routing logic supports regional intelligence to optimize performance across borders. - Improve Customer Experience

Nothing kills trust faster than a failed payment. By combining Orchestration, Smart Routing, and Smart Cascading, you ensure your customers can pay seamlessly, without unnecessary declines or delays. - Future-Proof Your Business

With orchestration at the core, you can easily add, test, or replace PSPs and acquirers without costly re-integrations, keeping you ahead of market and regulatory changes.

Why TransactaPay Is the Right Partner

We don’t just offer payment processing; we engineer intelligent orchestration solutions that evolve with your business and your market.

What Sets Us Apart:

- Global Acquirer Network: Local and regional processors in LATAM, Africa, Southeast Asia, Canada, and beyond.

- AI-Powered Decision Engine: Learns from every transaction to continuously improve routing logic.

- Customizable Rules: Set thresholds for costs, retries, geographies, and more—full control, zero guesswork.

- Compliance-First: Especially important for regulated verticals like iGaming and Forex, where compliance can impact approval paths.

Let’s Get Smarter About Payments

If you’re losing revenue due to payment failures, high fees, or international processing challenges, it’s time to take control.

TransactaPay’s Payment Orchestration, Smart Routing, and Smart Cascading are built to:

✔ Increase approval rates globally

✔ Reduce processing fees across regions

✔ Maximize every transaction opportunity

Get a free consultation and transaction analysis today.

Let us show you where your payments are leaking, and how we can fix it.

Comments are closed